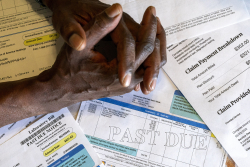

Americans expect that if they show up at an emergency department, they will be treated regardless of their ability to pay. But that expectation is under serious threat.

A federal law passed in 1986, the Emergency Medical Treatment and Active Labor Act (EMTALA), guaranteed that people would be treated no matter what. The law was passed to help patients who were being transferred to other hospitals or simply turned away from emergency rooms for financial reasons alone.

But the law, though well intentioned, had a weakness. It was unfunded, which placed a tremendous burden on hospitals. It also left open an important question: How much free care should be provided by emergency departments?

The American Medical Association estimated in 2000 that EMTALA obligations require physicians to provide approximately $4.2 billion annually in uncompensated care. However, that estimate comes from a limited study that is now more than 20 years old. Healthcare costs and the reimbursement landscape have changed dramatically since then.

The AMA estimate also did not consider the amount of uncompensated care provided to the underinsured, payments made that are less than the cost of care, payments that were not made because health plans rejected them, and the nonpayment of deductibles by patients. These costs have been rising significantly, especially in recent years.

Medicaid and Medicare reimbursement has lagged inflation for more than two decades. But hospitals and emergency physicians have continued providing care to the uninsured and under-insured because of revenue they receive from commercial insurers. This revenue is higher than other sources of payment under EMTALA’s requirements and it made the whole system work. It worked for 37 years.

But now, it’s unravelling. Our promise to provide equitable, timely access to health care is in danger.

In the last year, another well-intentioned law has threatened the delicate balance that has been in place. The No Surprises Act (NSA) of 2020 sought to protect patients from surprise, out-of-network bills for emergency care. The law has been successful. Its patient protections are laudable, effective, and have broad support.

But since it took effect in January 2022, the law has been a problem for emergency care clinicians. Insurance payors heavily influenced the rulemaking process, which has allowed these payors to dramatically reduce reimbursement rates. In addition, health plans have even terminated in-network agreements with healthcare providers. A modest decrease in reimbursement was expected. The gigantic drop that has happened was not expected. Most surprisingly, little or none of the reductions in provider reimbursement have been passed back to patients or employers. None of this should be tolerated.

The implication for America’s healthcare safety net is scary. The results include underfunded emergency departments, a worsening staffing crisis, increased ER wait times, ineffective care, delays of care for even time-sensitive conditions such as strokes and heart attacks, and a rise in closures of rural hospitals.

The result could be a country where, once again, patients are left without timely medical care, even in life-threatening situations.

In the immediate term, we should make the No Surprises Act work as the balanced system it was designed to be, rather than a system that favors insurance plans. We must support the independent dispute resolution process as it is written in the law. If implemented as intended, arbitration would be used rarely as opposed to frequently as it is now.

Other issues impact emergency clinicians as well. Medicare reimbursement for emergency care, for example, needs to keep pace with inflation and the rising cost of medical services. Annual rate cuts have put pressure on the clinical safety net and the cost-sharing that is required to maintain 24/7 emergency care networks.

Most important, providers and insurance payors need to agree on in-network contracts at fair rates of payment for emergency care. The No Surprises Act was supposed to incentivize these agreements. But it has further encouraged insurance companies to cancel in-network agreements, stall negotiations, and underpay physicians who have already treated patients.

Absent near-term fixes, the onslaught of regulatory, economic, and societal factors poses an imminent threat to the healthcare safety net we’ve depended on for nearly 40 years. We must work together to avoid these consequences.

Rich D’Amaro and Randy Pilgrim, MD, are the CEO and Chief Medical Officer, respectively, of SCP Health.